By Benjamin M. Lavine, CFA, CAIA, RICP

Chief Investment Strategist, Freedom Advisors & Chief Investment Officer, 3D, a Freedom Advisors company

On July 26, the Federal Reserve will meet and most likely announce another 0.25% rate hike to bring the benchmark overnight rate to 5.50%. The Fed Funds Futures market is signaling this will be the final rate hike for this cycle with the first rate cut expected to occur in the 2nd quarter of 2024. Unless inflation readings were to suddenly spike (the so-called second wave risk with the 1970s inflation cycles as a historical analog1), we may be approaching the end of this current rate hike cycle that began in March 2022 and saw the sharpest increase in interest rates versus prior rate hike cycles.

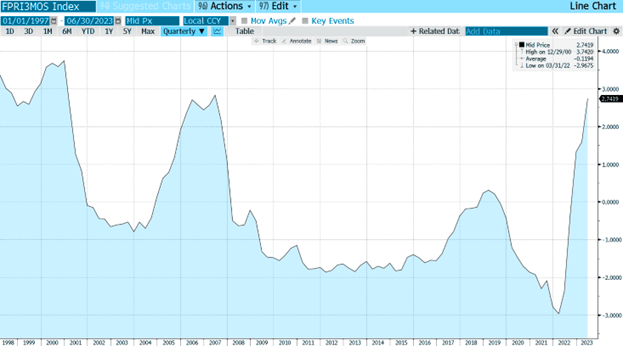

The Fed tightens until something breaks2 is a common refrain among strategists who see a bad ending to the post-pandemic booming economic recovery. Indeed, expected inflation-adjusted (real) interest rates have spiked to levels (Figure 1) typically preceding a “hard landing” – a scenario that had been reflected by economic consensus at the end of 2022 that would see the U.S. economy fall into recession sometime in the latter half of 2023.

Figure 1 – Per Philadelphia Branch of the Federal Reserve, Expected Real Interest Rates Have Spiked to Levels that Have Historically Preceded an Economic Contraction

Source: Bloomberg

Given how central bank tightening has historically played out, few are asking, “What If Nothing Breaks?” Dare we ask the same thing as we run the risk of reaching an Irving Fisher-esque3 moment just as the credit cycle is about to turn for the worst? We believe one historical analog may apply where rate hikes did not end when something broke: the 1994 policy tightening under then-Fed Chair Alan Greenspan.

Following the 1994 rate hikes, U.S. equities and bonds performed spectacularly up until the 2000 dotcom crash to be followed by the 2001-2002 Tech-Media-Telecom (TMT) high yield credit market crash, even with some notable market bending (but not breaking) moments, such as the Asian currency crisis in 1997 and the Russian debt crisis in 1998. It took almost 8 years for the 1994 tightening cycle to show up in high yield, and that was only after outright frauds like WorldCom and Enron catalyzed the TMT funding freeze. And such financial frauds are now more difficult to orchestrate under the Sarbanes-Oxley Act4, passed in response to the WorldCom and Enron frauds.

Similarly, we’ve seen our own moments of market bending (but not breaking) in our current tightening cycle such as the UK Gilt sell-off in the fall of 2022 and the regional banking crisis in March 2023. Granted, monetary policy operates with a lag (estimated to be around 12-18 months), so significant effects from Fed tightening have yet to materialize fully, apart from weakness seen in the commercial property sector, notably office space.

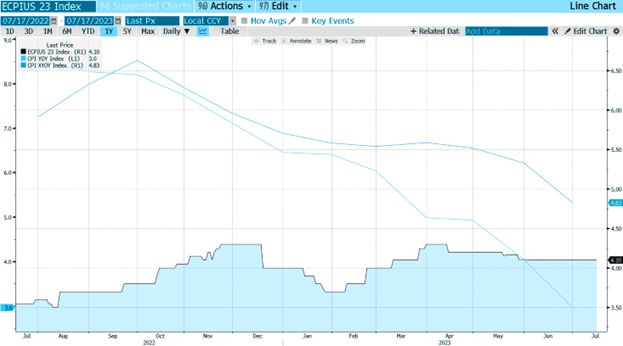

But what we observe at this point in the rate cycle is anything but straining financial markets and a U.S. economy succumbing to a deflationary recession. Year-over-year inflation (headline and headline ex-energy and food or core inflation) is tracking lower vs. what is expected by the end of 2023 (Figure 2). So, at first blush, the Fed’s tightening appears to be restoring some price stability (debates will continue to rage over the causal link between monetary policy and observed inflation trends).

Figure 2 – Letting Nature Take Its Course: Actual Inflation Readings (CPI and Core CPI) Trending Lower versus Expected Headline Inflation of 4.1% for CY-2023

Source: Bloomberg

Does the Fed have enough fiscal gas left in the tank to let nature take its course, bringing down inflation without crashing the economy by curtailing excess demand through higher unemployment?

First, as many have highlighted (and what we highlighted in our 2nd Quarter 2023 Market Commentary), the U.S. net aggregate balance sheet still enjoys a financial buffer from post-pandemic stimulus measures even after having been drawn down.

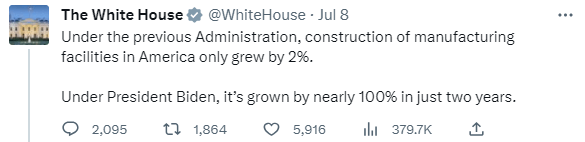

Second, the Inflation Reduction Act and the CHIPS Semiconductor Act have provided infrastructure spending fuel at the federal and state/local level. Consider this boast from the Biden Administration (and even more boast-worthy from an inflation-adjusted perspective)5:

Third, the National Unemployment Rate remains at a near-cyclical low of 3.6% with an estimated 1.5 million job losses needed to bring that rate up 1%. A significant rise in unemployment of that magnitude would need a systemic-level endogenous shock catalyzed by monetary policy tightening, but there are few signs of excess capacity and overinvestment fueled by excess leverage.

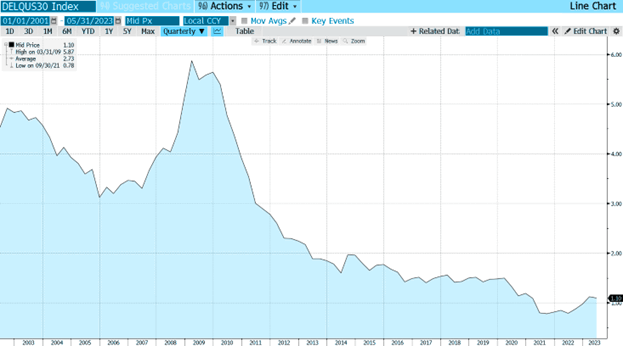

Fourth, the credit markets appear to be handling higher interest rates after getting over the initial shock, easing into a positive real rate and higher cost-of-capital reality. Loan delinquencies are on the rise, especially in consumer credit (credit cards, autos) but remain below pre-pandemic trend levels. Figure 3 displays the 30+-day delinquency rate of credit card balances which are ticking higher but still look benign relative to pre-pandemic levels.

Figure 3 – Consumer Credit Delinquencies Are on the Rise but Remain Below Pre-Pandemic Trend Levels

Source: Bloomberg. US Credit Card Delinquencies 30+ Days Composite (Average Rate for the Following Trusts: Amex (Revolving), Bank of America, Capital One, Chase, Citibank, and Discover)

Unlike pre-2008 (Great Financial Crisis), the regulated banking system operates with significant capital constraints thanks to Dodd-Frank and Basel 3 regulations. Private non-regulated credit lending has also proven to be more resilient in the face of higher interest rates, likely due to more disciplined underwriting and mandated capital cushions of middle-market lending through Business Development Corporations (or BDCs).6

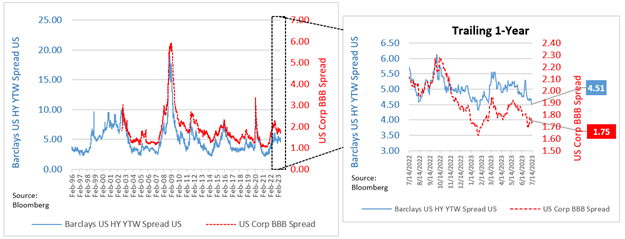

Corporate credit markets have grown more sanguine following the risk-off eruptions stemming from the September 2022 UK Gilt sell-off and March 2023 Regional Banking Crisis. High Yield and BBB-rated Credit spreads (Figure 5) are well off their recent wide levels (as of 7/14/2023).

Figure 5 – Corporate Credit Spreads (High Yield and BBB-Rated) Have Narrowed as Credit Markets Ease into a New Regime of Higher Interest Rates and Tighter Borrowing Conditions

Finally, Mohammed A. El-Erian from Allianz is one of the few macro strategists to ask the question, “What If Nothing Breaks?” He penned a Bloomberg Opinion piece7 just before we published this blog article but succinctly summarizes the soft-landing scenario of some market bending, but not breaking:

“The concept of a soft landing is underpinned by four hypotheses: Inflation will continue to decline in a consistent linear fashion; the Fed will cease raising rates after this month and then cut them, ensuring the economy avoids an overtightening that could trigger a recession; the economy possesses enough resilience to absorb the delayed effects of the rate hikes; and both banks and NBFIs have strong-enough balance sheets and retain affordable refinancing channels.”

As seen above, we can start checking off most of those boxes. This does not mean that risk-on assets, particularly risky fixed income, are a hands-with-full-fists buying opportunity as risk-reward (valuations matched with consensus outlook) need to be vigilantly assessed. And nothing breaking can mean that the Federal Reserve stays tighter-for-longer as long as current inflation readings remain elevated and well above the long-term average target of 2%. But, barring a significant breakage resulting from tightened monetary policy, a soft-landing scenario is coming within full view as we near the end of the rate hike cycle (fingers crossed).

1. “Today’s global economy is eerily similar to the 1970s…”, Brookings Institute 7/1/2022

2. “Fed tightening always breaks something…”, Marketwatch 2/17/2023

3. “Irving Fisher,” Wikipedia

4. “Sarbanes-Oxley Act,” Wikipedia

5. https://twitter.com/EdZarenski/status/1677705828759924736

6. “BDC Primer: Balance Sheets in the Banking Storm”, Bloomberg Intelligence 7/17/2023

7. “Markets Are Propelled by What Hasn’t Happened,” Mohamed El-Erian, Bloomberg Opinion, 7/17/2023

Disclosure:

The above is the opinion of the author and should not be relied upon as investment advice or a forecast of the future. It is not a recommendation, offer or solicitation to buy or sell any securities or implement any investment strategy. It is for informational purposes only. The above statistics, data, anecdotes, and opinions of others are assumed to be true and accurate however 3D Capital Management, LLC ("3D") does not warrant the accuracy of any of these. There is also no assurance that any of the above are all inclusive or complete. This article does not constitute an offer to sell or a solicitation of an offer to purchase interests in any investment vehicles or securities. This article is not a prospectus, an advertisement, or an offering of any interests in either the Strategy or other portfolios. This article and the information contained herein is intended for informational purposes only. It does not constitute investment advice or a recommendation with respect to investment. Investing in any strategy should only occur after consulting with a financial advisor.

3D does not approve or otherwise endorse the information contained in links to third-party sources. 3D is not affiliated with the providers of third-party information and is not responsible for the accuracy of the information contained therein.

Past performance is no guarantee of future results. None of the services offered by 3D are insured by the FDIC and the reader is reminded that all investments contain risk. The opinions offered above are as of July 17, 2023 and are subject to change as influencing factors change.

More detail regarding 3D, its products, services, personnel, fees and investment methodologies are available in the firm’s Form ADV Part 2 which is available upon request by calling (860) 291-1998, option 2 or emailing sales@3dlfinancial.com or visiting 3D’s website at 3d.freedomadvisors.com.